Halifax is a leading banking company in the UK offering a wide range of financial products and services to its customers.

- A variety of banking accounts offered to suit every individual needs

- Convenient online and mobile investment platform

- Has a nationwide network of branches, making it easily accessible to all UK users

- Regulated by the FCA and protected by the Financial Services Compensation Scheme (FSCS)

- The service provider only focuses on the UK clients, thus limiting clients looking for international banking and investment options

- No demo account

Halifax is a leading banking company in the UK offering a wide range of financial products and services to its customers. Established in 1853, Halifax has a rich history of providing innovative and reliable banking and investment solutions to individuals, families, and businesses. Whether you want to find a mortgage, invest for the future, or apply for loans, Halifax is your one-stop online platform.

Below, we review Halifax to help you get familiar with how it can benefit your investment plans. You will understand its security measures, asset offerings, fees, and more. Ultimately, you should be able to decide whether Halifax is the right investment partner for you.

Halifax – Who Are They?

Halifax, formerly known as Halifax Building Society, has a network of branches and ATMs across the UK known to offer a convenient and easy-to-use online banking and investment platform. With a strong focus on customer service and a commitment to responsible banking and investment practices, Halifax is trusted by millions of clients. Undoubtedly, the company is a reliable choice for those seeking a financial partner.

Besides featuring various bank accounts for UK individuals, Halifax also helps you with your mortgage plan. There are also ISAs that allow you to invest in stocks and potentially earn profits in the long run. Other services you get to benefit from using Halifax include insurance on home, car, and life, wealth management, retirement, loans, car finance, and more.

Compare Halifax Features With Other Brokers

Compare brokers

Licenses and Security

Halifax financial services company is secured and regulated by the Financial Conduct Authority (FCA). All eligible investments at Halifax are also protected by the Financial Services Compensation Scheme (FSCS). The licenses ensure that Halifax adheres to strict rules and regulations regarding its operations, including those related to consumer protection, anti-money laundering, and financial crime prevention.

Halifax places a high priority on the security of its customers’ information and finances. The company has implemented advanced security measures, such as multi-factor authentication, encryption, and firewalls, to protect its online banking systems and prevent unauthorised access to customers’ accounts. In addition, the company has a robust fraud detection system that monitors transactions for unusual activity and alerts customers if any suspicious activity is detected on their accounts.

Assets Offered

There are numerous products and services at Halifax to meet the financial needs of its customers. These include current accounts, savings accounts, mortgages, personal loans, credit cards, insurance, and investment products.

With these products, UK customers can easily invest or save for their future. For instance, Halifax’s current accounts are designed to give customers an easy and convenient way to manage their day-to-day finances. The savings accounts also offer a range of options for customers to save for their future goals.

Regarding mortgage products, Halifax offers a variety of options for customers. You can also take advantage of the personal loans offered to improve your home, consolidate debts, or make large purchases. If you are looking for financial assets, Halifax allows you to grow your wealth by investing in a range of asset classes, including stocks, bonds, funds, ETFs, Gilts, and investment trusts.

Halifax Fees, Commission, and Spread

Like many banking companies, Halifax charges fees for certain products and services. Some of the fees that Halifax charges include overdraft fees for exceeding the agreed limit on a current account, annual fees for credit cards, and early repayment charges for personal loans. The company also charges a fee for transferring money from one account to another and for services such as replacing a lost or stolen debit card.

In addition to fees, Halifax also earns revenue from spreads and commissions earned on stocks, bonds, ETFs, and funds investments. However, note that international trades are commission-free, and you will not incur deposit, withdrawal or inactivity fees. Although Halifax’s investment fees are relatively low compared to other brokers, expect an annual £36 administration fee on your ISA and share dealing account. Regarding SIPPs cost, a £22.50 per quarter applies if the SIPP value is £50,000 or less, or £45 if the value is above £50,000.

| Type | Fee |

|---|---|

| Minimum deposit | $0 |

| Deposit fee | $0 |

| Withdrawal fee | Foreign currency transaction fee of 2.99% of the amount of the transaction |

| Inactivity fee | $0 |

| Administration fee | Annual £36 |

Deposit Methods and Supported Currencies

Halifax has no minimum deposit requirement and offers several methods for customers to deposit funds into their accounts. These methods include debit/credit cards, bank transfers, and over-the-counter deposits at a Halifax branch.

In terms of supported currencies, Halifax primarily deals in GBP UK currency. However, the company may also allow customers to hold and transact in other major currencies, such as USD, EUR, and JPY. The availability of other currencies may vary depending on the customer’s location and the type of account they hold. Also, currency conversion fees apply when transacting with currencies besides the GBP.

Platform and Research Tools

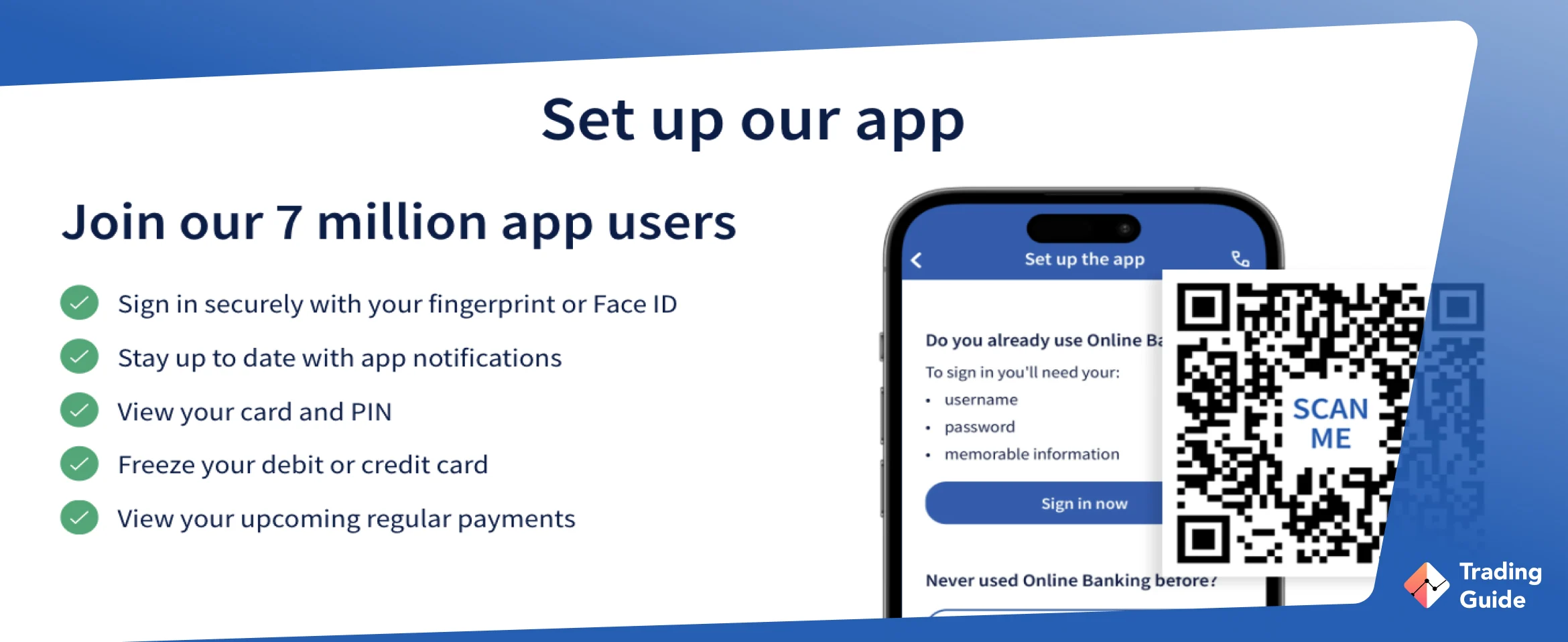

Halifax has a user-friendly web trading platform to cater for newbies and professional investors. You can also download its mobile banking app from Google Play or the App Store to easily manage your funds on the go. When it comes to the broker’s research page, you will find many useful resources, including fundamental data and trading ideas. However, accessing these resources can be challenging, especially for newbies.

To easily find Halifax research tools, locate its share dealing platform, then click “Research the market”. From there, you will access various investment ideas, market news, watchlists, and many more. There are also tutorials for newbies looking for how to use its account. On top of that, Halifax features general educational content in the form of videos, webinars, articles, and quizzes.

How To Register a Halifax Account

Registering for a Halifax share dealing account is a pretty straightforward process. If you want to invest with Halifax, we take you through the procedures below.

- Visit the Halifax website by clicking one of the links we’ve shared on this page. You can also Google Halifax and access its platform.

- On the top navigation bar, click “investing” to access the platform. At this point, we advise you to read and understand the broker’s terms and conditions so you can be sure of what you are getting into.

- Click “start investing” and be redirected to a page showing all accounts option to select the share dealing account.

- Scroll down the page to open a share dealing account using your personal details, including your name, date of birth, occupation, nationality, contact details, etc.

- Verify your identity by providing proof of your address and identity. This can be done using your passport, driving license, or National Insurance number.

- Choose any additional features or products you would like to add to your account, such as overdraft protection, insurance, or online banking.

- Review and agree to the terms and conditions of the account.

- Submit your application and wait for a confirmation from Halifax.

- Once your account is approved, you will receive a welcome pack with all the information you need to start using your account.

Editor’s Note

Being a well-established financial institution in the UK, we consider Halifax an excellent choice for individuals looking for a reliable banking and investment partner. Its online banking offers a range of products and services to meet the needs of individuals and businesses. Plus, the bank is known for its low-interest rates, convenient online and mobile banking services, and highly encrypted platform.

We also like Halifax’s investment options, although they are not as comprehensive as what other UK brokers offer. The investment platform is suitable for stock, ETFs, funds, and gilt investors. By investing in these products, rest assured of receiving quality professional assistance. As a result, you will easily improve your skill level and hopefully grow your wealth over the long term.

Overall, Halifax is a secure investment partner regulated by the FCA and protected by the FSCS. Its trading fees are low, and you will not incur deposits, withdrawals, or inactivity charges. Sadly, we weren’t impressed by its support service since it doesn’t operate 24/7. There is also no live support; you can only get in touch with the team via phone, email, and social media platforms. We recommend Halifax for long-term investors.

FAQs

Yes. Halifax is a reliable bank and investment platform regulated by the FCA and FSCS. It is one of the largest banks in the UK, serving millions of customers and offering a wide range of financial products and services. Plus, Halifax is highly encrypted, guaranteeing its users’ information safety.

Yes. Halifax provides a share dealing service that allows customers to buy and sell shares online. You can also trade ETFs, funds, bonds, and more at a low cost. This service is provided through its online brokerage platform, which is easy to use for all types of investors.

Yes. Halifax Bank provides a share dealing service that allows customers to buy and sell shares online. You can start your investment ventures with as little as £50 since the broker has no minimum deposit requirement.

No. Halifax is not owned by the government. It is a subsidiary of the Bank of Scotland, which is part of the Lloyds Banking Group.

Halifax is a British bank and is part of the Lloyds Banking Group, headquartered in the UK. Besides online banking services, Halifax offers a superior investment platform that UK individuals can use to grow their wealth across various assets.

Yes. Halifax was previously known as the Halifax Building Society. However, it was acquired by the Bank of Scotland in 2001 and became part of the Lloyds Banking Group in 2008.

Personally, I've never had an issue with Halifax. Excellent bank and good customer service. The app is very user-friendly and easy to use. Keep it up Halifax!

Personally, I've never had an issue with Halifax. Excellent bank and good customer service. The app is very user-friendly and easy to use. Keep it up Halifax! I would recommend.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

The fees are reasonable for what you get, though I wish they'd modernize the interface because it feels quite dated compared to newer investment apps.